By Steve Worth

What do the numbers 1.52 million and 30,269 have in common? They are both all-time highs; in the US Covid-19 infection count, and the Dow Jones Industrial Average. An increasing number of people are struggling with the many difficulties caused by this health crisis, yet Wall Street marches to higher ground while seemingly ignoring the “costs”. Why is the stock market delinked from the wider reality? Will the next move in equities be a pandemic-led correction or the confirmation of a brighter future? Further, now that we know who will move into 1600 Pennsylvania Avenue on January 20, 2021, how does a Biden White House impact investment strategy in 2021?

In a July blog we spoke about employing a bar-belled approach; to capture technology and innovation on one side, and an economically sensitive cyclical stock recovery on the other. We forecasted that low interest rates and unprecedented stimulus would inevitably improve economic conditions and growth rates. We cited how new innovative products and services will continue to change our future. And we focused on the themes on the economically sensitive side of the barbell that would catch up with the already-appreciated innovation side as life began to normalize. Happily, we saw that performance gap begin to close in the fall – and we continue to advocate this investment approach.

In a nutshell, the market is delinked from the wider economic reality because it is forward looking. It expects continued government action that will assist companies and individuals and pull the economy back to its normal growth trajectory. It expects interest rates to stay low for a very long time, and it believes that economic conditions will reel the pandemic into submission – not the other way around. These expectations and beliefs seem baked into investor’s thinking. What is less understood by investors is how a Democrat in the Oval Office may impact our investment expectations over the next few years.

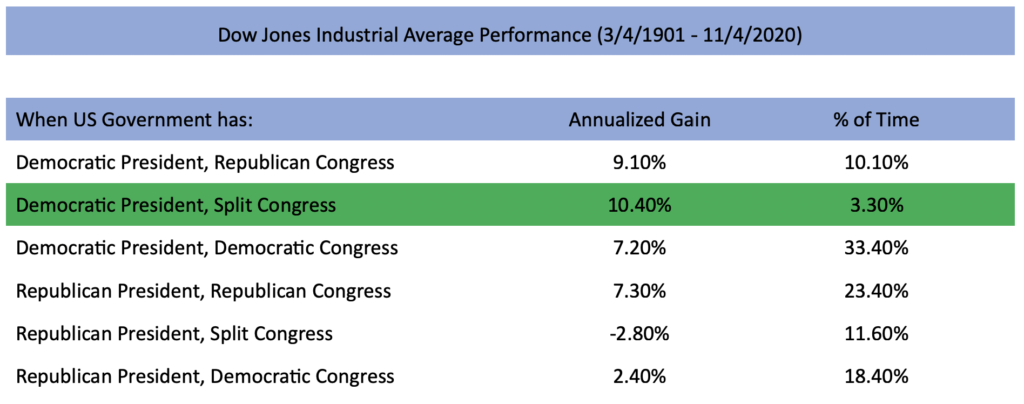

While we wait on the results of the Georgia Senate runoffs, we will have a Democratic majority in the House and Joe Biden as President. However, Democrats did lose 10 seats in the House, and given the peculiarities of Washington, this Republican gain may allow the most progressive edge of the Democratic caucus to exert more policy shaping pressure. As investors, this might worry you. Yet, if we look at history, we find that you would be worrying for no reason. In November, Ned Davis Research published the following table which details the annualized return of the Dow Jones Industrial Average by which party held the Oval Office and which party-controlled Congress.

Pending the results of the Georgia Senate runoff we find ourselves in the category highlighted in green. While this government configuration has only occurred 3.3% of the time over the past 119 years, it did deliver the highest annualized returns. We cannot tell you what 2021 will bring but we are attentively optimistic. We choose to focus on a balanced asset allocation, as worrying is not a strategy. Here’s to happy holidays for all. And we’ll take any kind of normal new year.

Indices mentioned are unmanaged and cannot be invested into directly. Diversification and asset allocation strategies do not assure profit or protect against loss. Past performance is no guarantee of future results. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including loss of principal.